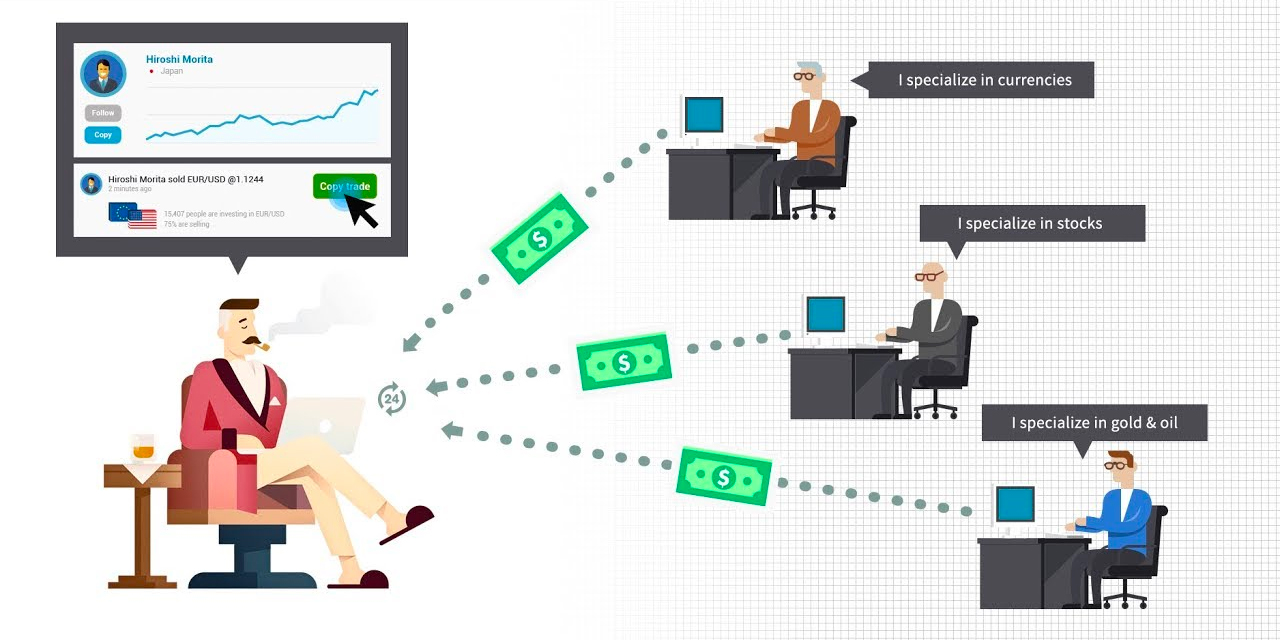

Copy trading, sometimes known as social trading, is when an investor’s trade is copied by another. Within a copy trading network, traders can broadcast their strategies for others to complete the same trades.

Just like with regular trading, copy trading looks to invest in various financial markets, and includes contract for difference (CFD), trading on forex (FX), stocks, commodities, indices and cryptocurrencies - opening and closing a position on these assets once the value has increased or decreased.

A “follower” should research the “Strategy Provider” and their track record of investments, and ensure that the leverage is similar, and that the results and trading style is suitable.

FXBOX offers Copy Trading via a software called MetaTrader. This is a web-based system integrated with the MetaTrader platform, which means you will have to access FXBOX MetaTrader if you want to engage in Copy Trading.

MetaTrader is designed based on an “equity to equity” approach. This means, that if a Strategy Provider has $10,000 in his account, and the Investor (Follower) only $1,000 in his account, the Investor’s (Follower’s) positions will be 1/10 as big as those of the Strategy Provider, to ensure similar return on investment in percentage terms.

Investors allocate funds to connect to a trading strategy directly from the MetaTrader platform. Once funds are allocated, a Copy Trading Account is automatically created, which is a separate account under your FXBOX account This account is used for copying the chosen strategy. As the Strategy Provider places trades, these are automatically copied using an equity-to-equity model.

Copy trading began in 2005, where it evolved from the mirror trading taking place between investors in the financial markets. Traders were copying the strategies that were created by algorithms through automated trading. The developers of these algorithms shared the insights to their investments, allowing others to mirror their trading history.

As this developed, it began to form a social trading network. Eventually, investors began to copy the trading methods of other investors, as well as copying the exact trade itself rather than just the strategy.

Copy trading became so popular that specific sites were created just for this network, offering the opportunity to trade in the stock or forex market for the first time, for example; to invest in a different, unknown market; or even to trial the copying of other traders with a demo account.

As a novice trader, copy trading allows you to explore and understand the financial markets, and learn when and where to buy and sell. It provides access to the expertise of more knowledgeable traders, and the possibility to consider potential opportunities otherwise overlooked – although it is advised to still research the market that the copied trade is taking place in.

With copy trading, you are able to trade on various instruments including FX, stocks or indices. There is also a community aspect created, with all levels of traders given the opportunity to share and exchange ideas, strategies and trading education.

For more experienced traders, it can become an additional revenue stream in the form of fees.

Play together with professionals, study the practices of the best brokers